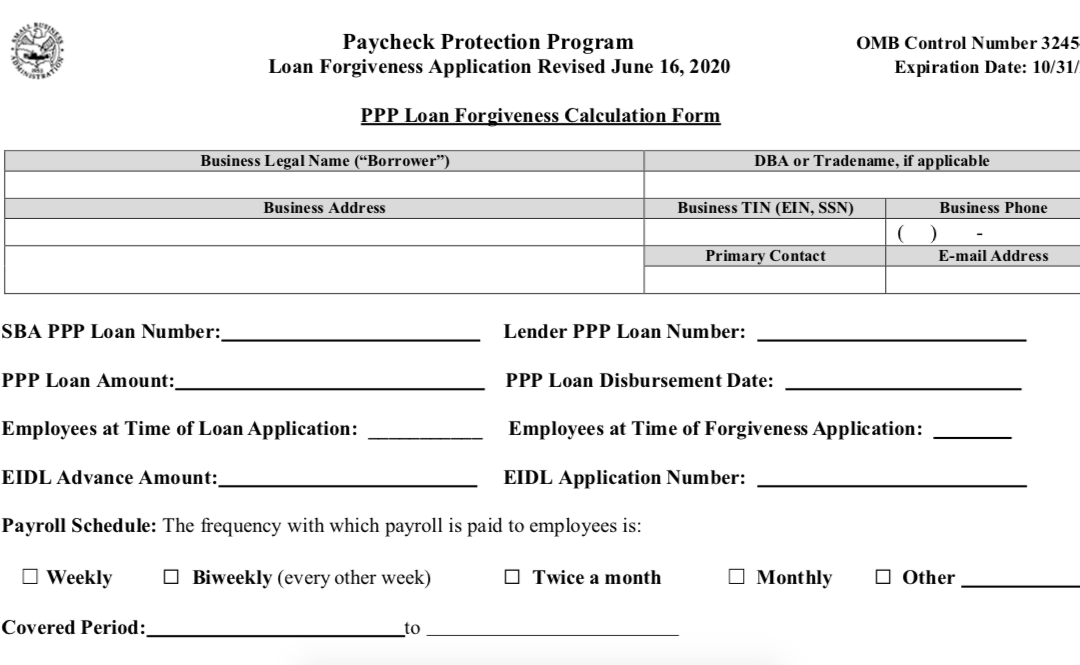

Logically if you receive money and dont have to pay it back then that should be considered income right. You may submit a loan forgiveness application any time on or before the maturity date of the loan which is either two years or five years from loan origination.

Sba Payroll Protection Program Loans Country Bank

See important update above to pay back your PPP loan and the 1 interest that accrues from the time that you receive it.

Do you have to pay back ppp loan. PPP Loan Repayment. You can also find your maximum forgiveness amount from your payroll costs. Start by taking your gross income as reported on line 7 of a 2019 or 2020 Schedule C.

You will then need to subtract any payroll costs as reported on lines 14 19 and 26. A 1 interest loan with a six-month deferment is by any objective measure an absurdly good loan. Unless you meet some very specific criteria to be discussed below.

Yes and notwithstanding the very low interest rate you should if you can afford to do so. Use at least 60 for payroll costs and 40 for qualifying non-payroll costs. Contact your lender to ask for instructions for returning your PPP loan.

Do You Have to Pay Back PPP Loan. All borrowers regardless of PPP loan amount must use 100 of the loan for eligible expenses for PPP loan forgiveness. 8 Tips and Warnings on PPP Loan Forgiveness Not having to pay back Paycheck Protection Program loans is a huge benefit for small-business owners.

Paycheck Protection Program loans were made by lenders not by the Small Business Administration. Unlike other SBA loans PPP loans are designed to be partially or fully forgivable meaning you wont have to pay them back as long as you follow certain rules. PPP lenders are not permitted to levy prepayment penalties or any other charges for loan payments.

The PPP is a loan. Eligible expenses include payroll and qualifying non-payroll costs. These business loans are backed by.

OTHERWISE YOU WILL NEED TO PAY THE PPP LOAN BACK. If you are running payroll costs your PPP loan calculation requires a few more steps. You CAN use your funding for any legitimate business expense but if you use your loan for anything other than PPP-approved payroll costs mortgage rent and utilities expect to pay back at least that portion of your loan.

23 2021 Updated 208 pm. You must pay your loan back to your lender not to the SBA. Here are a few key facts about the first round of PPP loans.

It is not a grant. Since the intent of the bill is to save American jobs and businesses there are provisions built into the loan program to motivate you. If youre the recipient of PPP loan funds its absolutely critical you understand that.

The PPP funds must be paid back. And the SBA requires you to use the majority of your loan for payroll expenses. The Federal Government made the 2 trillion CARES Act into law.

The short answer to this question is that you have 5 years previously two years. Simply divide your total payroll costs by 06. Business Owners Dont Have to Pay Back PPP Loans If They Follow Terms of Forgiveness.

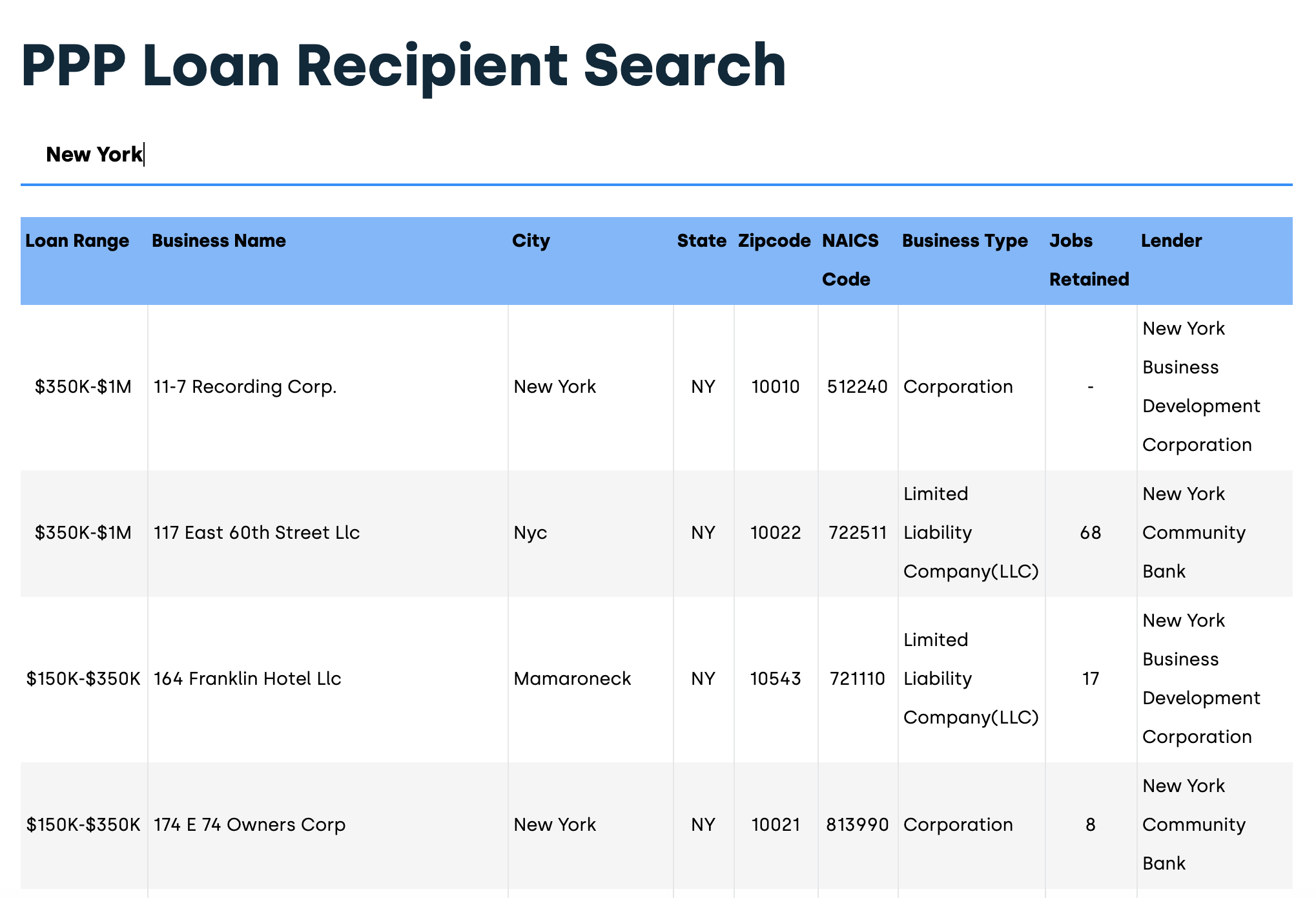

The 20000 is now due back to the government with some possible jail time as well if shes not lucky. The Small Business Administration SBA gave out 669. Qualified businesses could receive 25 times their average monthly payroll costs up.

Lakeisha Golden is currently asking for donations on GoFundMe to help pay back a paycheck protection program Loan Or PPP Loan that she took out to provide for her family. This means 15000 of the 20000 loan is forgiven and they have to pay back the remaining 5000. A PPP loan can be forgiven as long as at least 60 has been spent on employee payroll.

3 You Dont Think You Can Pay The Loan Back In Two Years If you dont qualify for forgiveness or only qualify for partial forgiveness youll be stuck with an installment loan. How long do I have to pay back my COVID-19 PPP loan. The only way you will have to pay back all or part of a PPP loan is if you dont use it for the specific items outlined above.

This is 75 of the minimum payroll cost required for full forgiveness so their forgiveness amount is 75 of the loan. This pool of money will be used to provide financial help for Individuals businesses and families during these hard days of uncertainty and recession. But there are a lot of rules that must be followed.

The value you find after subtracting the payroll costs is capped at 100000. However if you do not apply for loan forgiveness within 10 months after the last day of your covered period in this case the SBA assumes you are using the maximum length 24-week covered period loan payments are no longer deferred and you will be required to begin making payments on your PPP loan. If you keep or re-hire to meet your pre-COVID-19 levels of employment and compensation and spend funds on approved expenses your PPP loan will be forgiven meaning you dont have to pay it back.

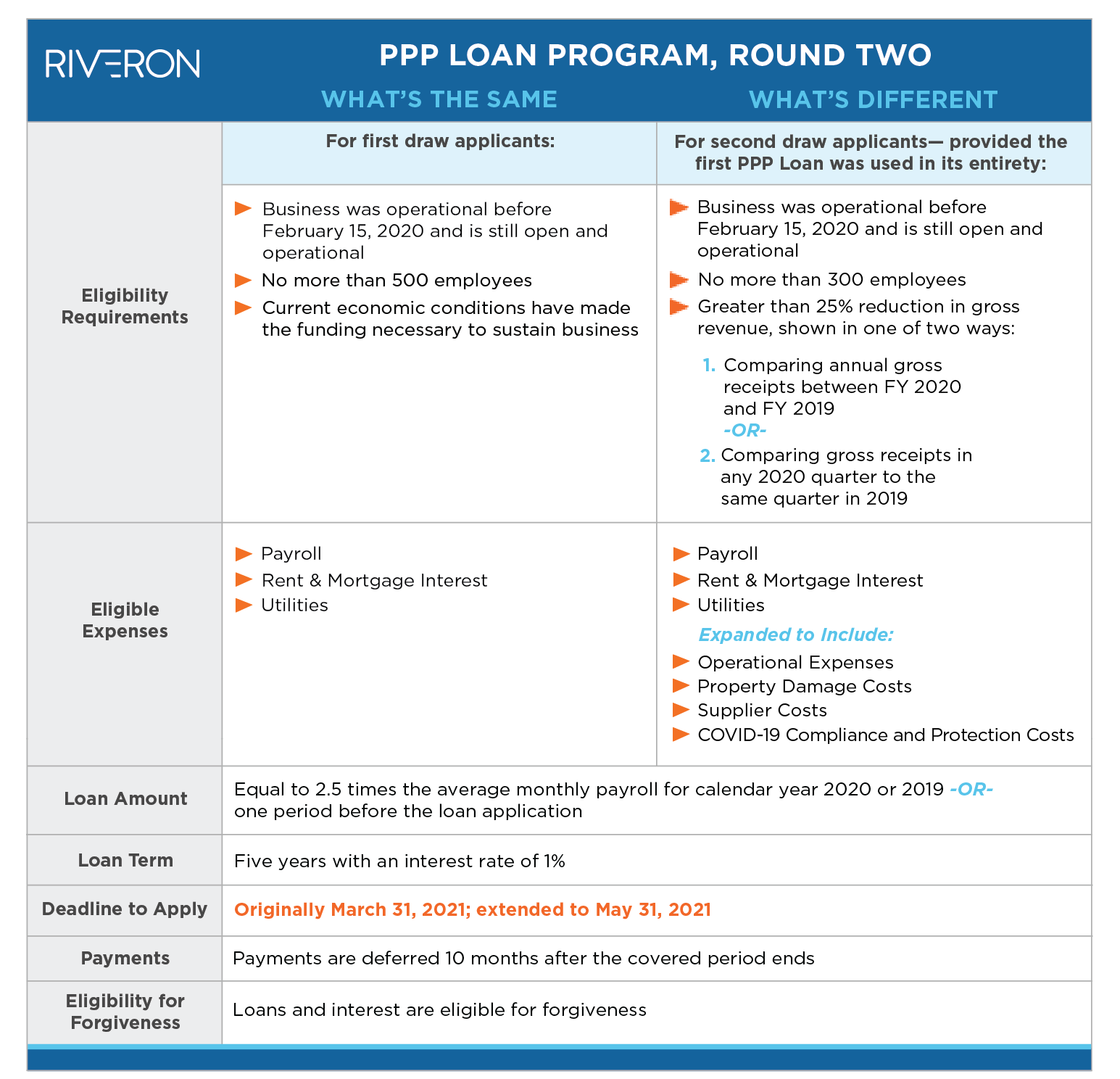

The Paycheck Protection Program PPP is still in effect but businesses must apply for eligible funding by May 31 2021.

Everything You Need To Know About Ppp Loans In 2021 Funding Circle

How To Track Ppp Loan Expenses For Self Employed Individuals Updated Template Included Youtube

Documents Needed To Retain For Ppp Loan Forgiveness Pw Associates Cpas

Ppp Loan Forgiveness Application Simplified Walk Through Form 3508s Youtube

5 Tips For Nonprofit Success In Ppp Loan Forgiveness Meeting Navigating And Reporting For Ppp Loan Forgiveness Cpa Practice Advisor

4 Options To Track Your Ppp Loan Explained

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

The Latest Round Of Ppp Loans Accounting And M A Considerations Riveron

Pin On Paycheck Protection Program

Sba Ppp Loan Approval Statistics Bryan Cave Leighton Paisner Jdsupra

My Ppp Loan Is The Wrong Amount What Can I Do Bench Accounting

The Top 5 Online Lenders Accepting Ppp Applications Update January 2021 Crossing Broad

How To Spend Ppp Money And Ask For Forgiveness Tom Copeland S Taking Care Of Business

Paycheck Protection Program How It Works Funding Circle

Top Ppp Loan Lenders Updated Approved Banks Providers

The Path To Ppp Loan Forgiveness Start Preparing Right Away Wiss Company Llp

For Ppp Loans Small Business Owners Should Stop And Think Before Seeking Forgiveness

Here S How To Lookup All Ppp Loan Data And Ppp Loan Recipients