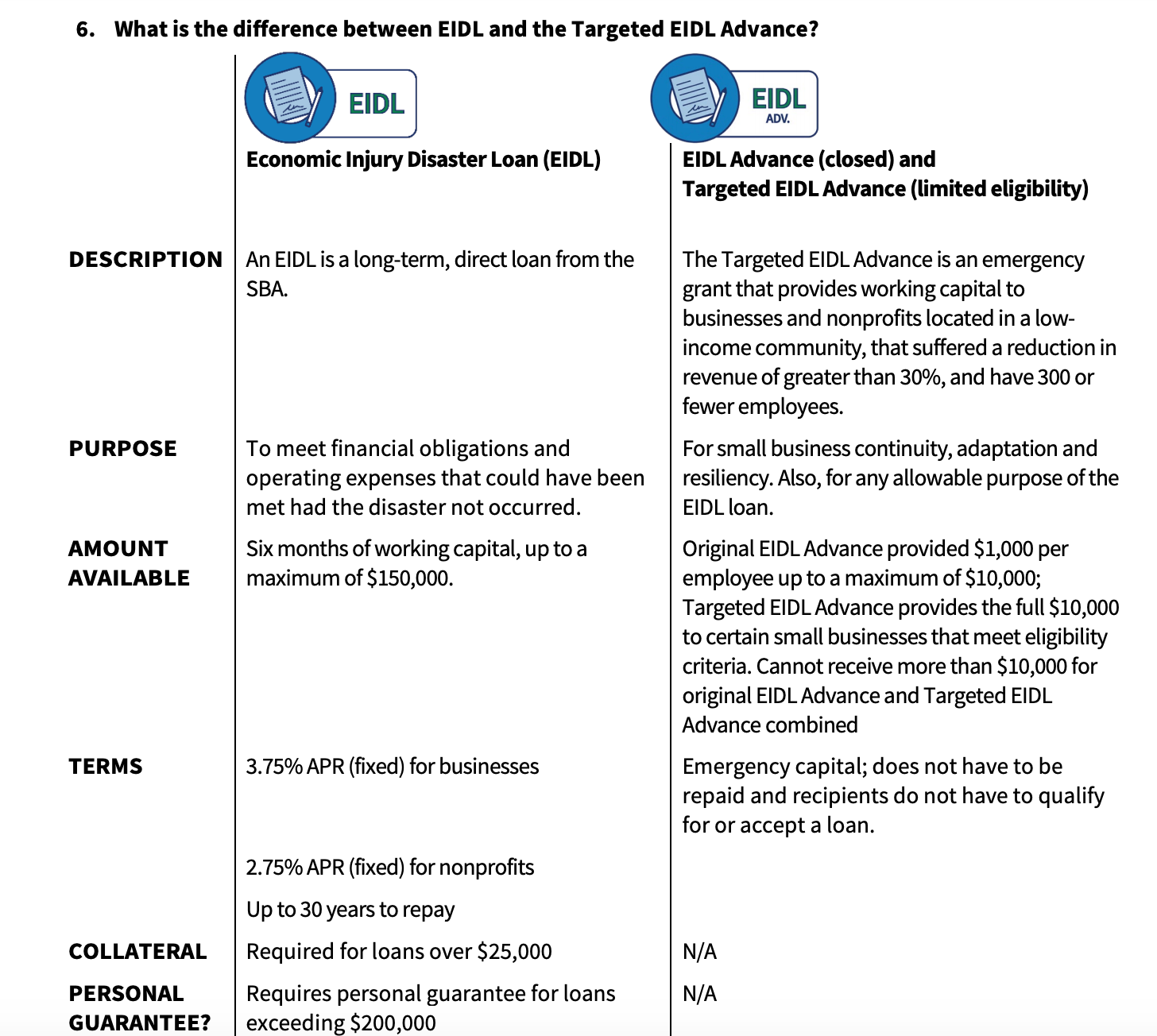

To meet financial obligations and operating expenses that could have been met had the disaster not occurred. The SBA can provide up to 2 million in disaster assistance to a business.

Eidl Loan Terms Explained Good Summary Eidl

1 day agoTo further meet the needs of US.

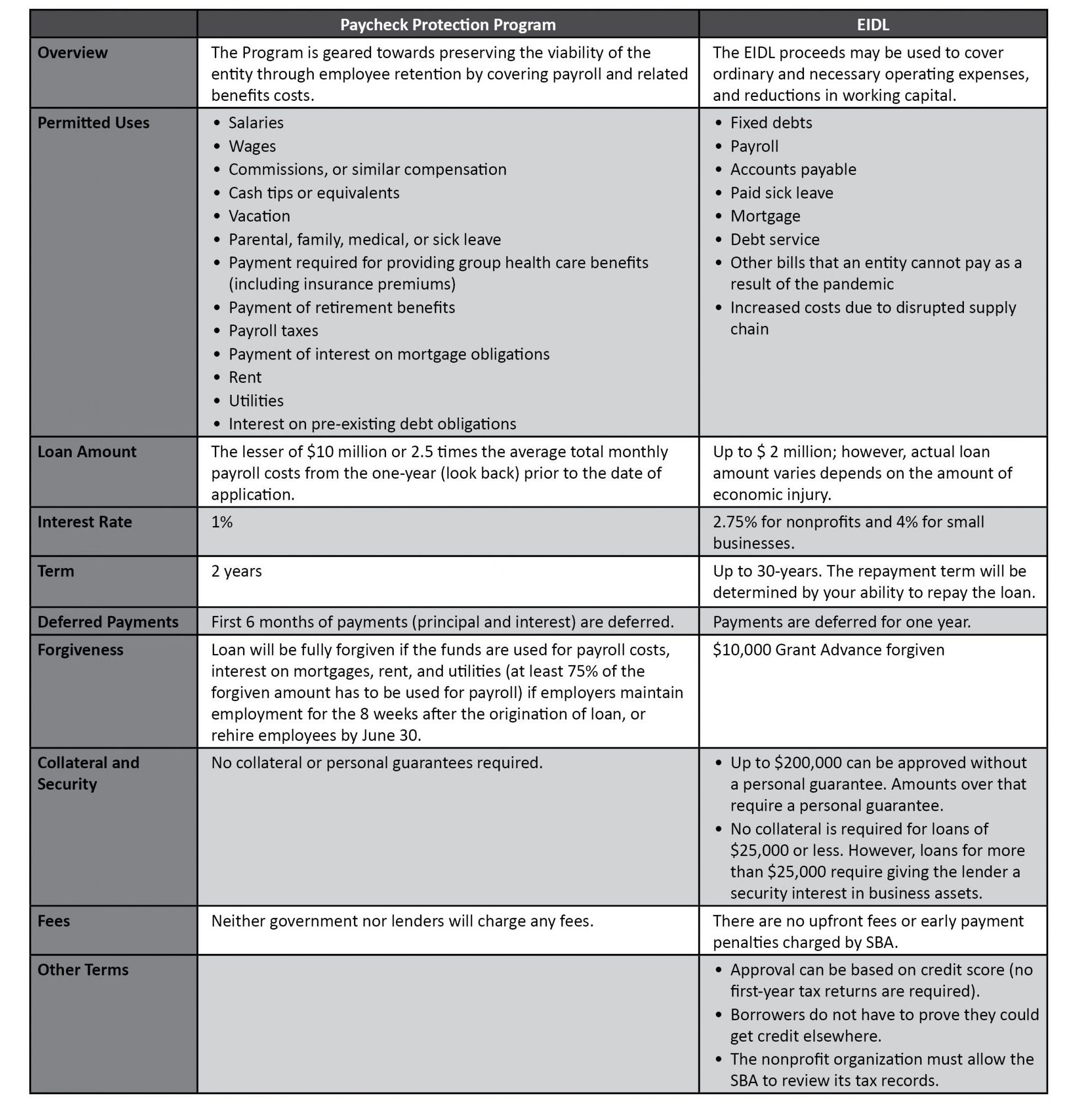

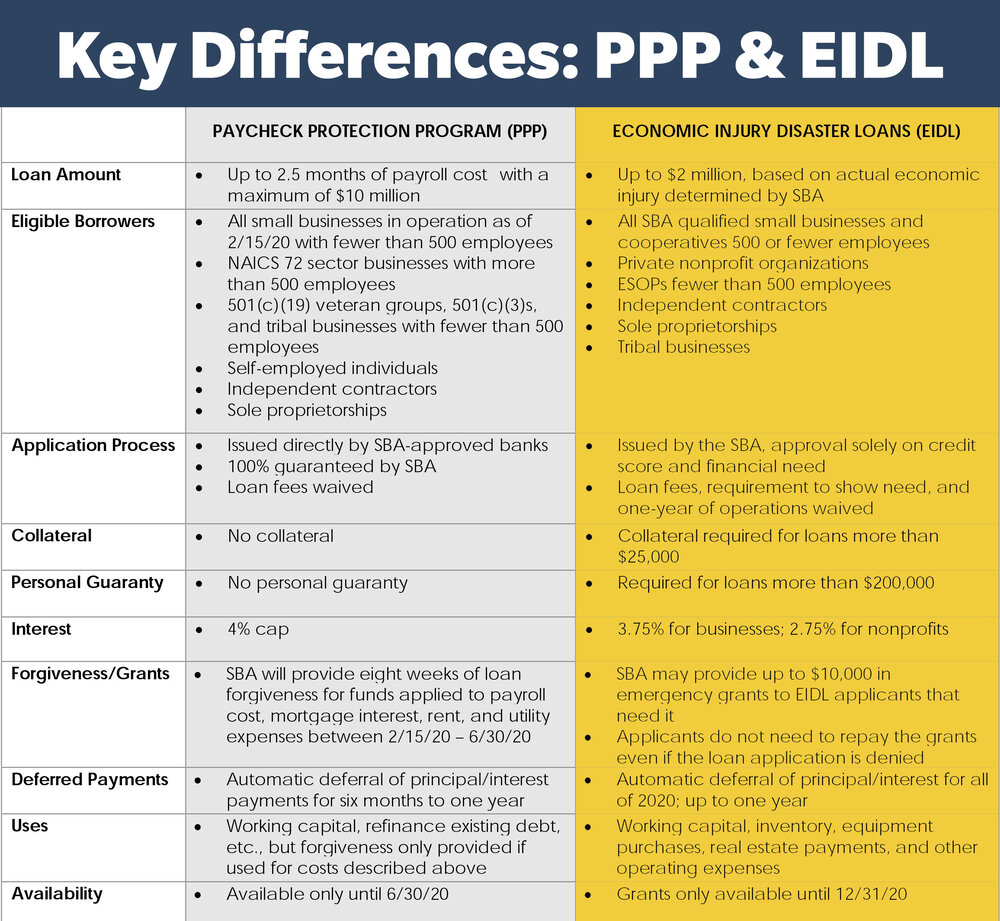

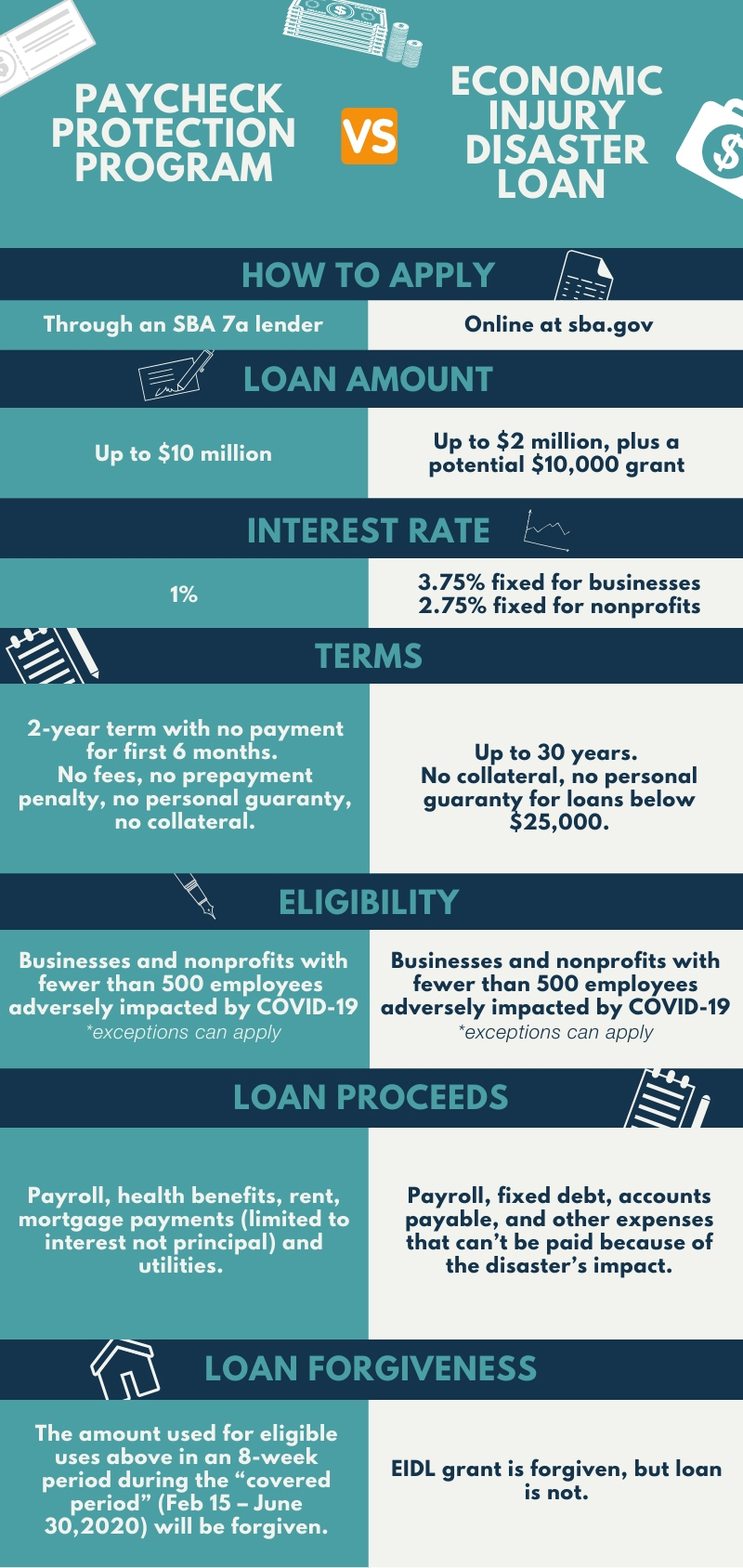

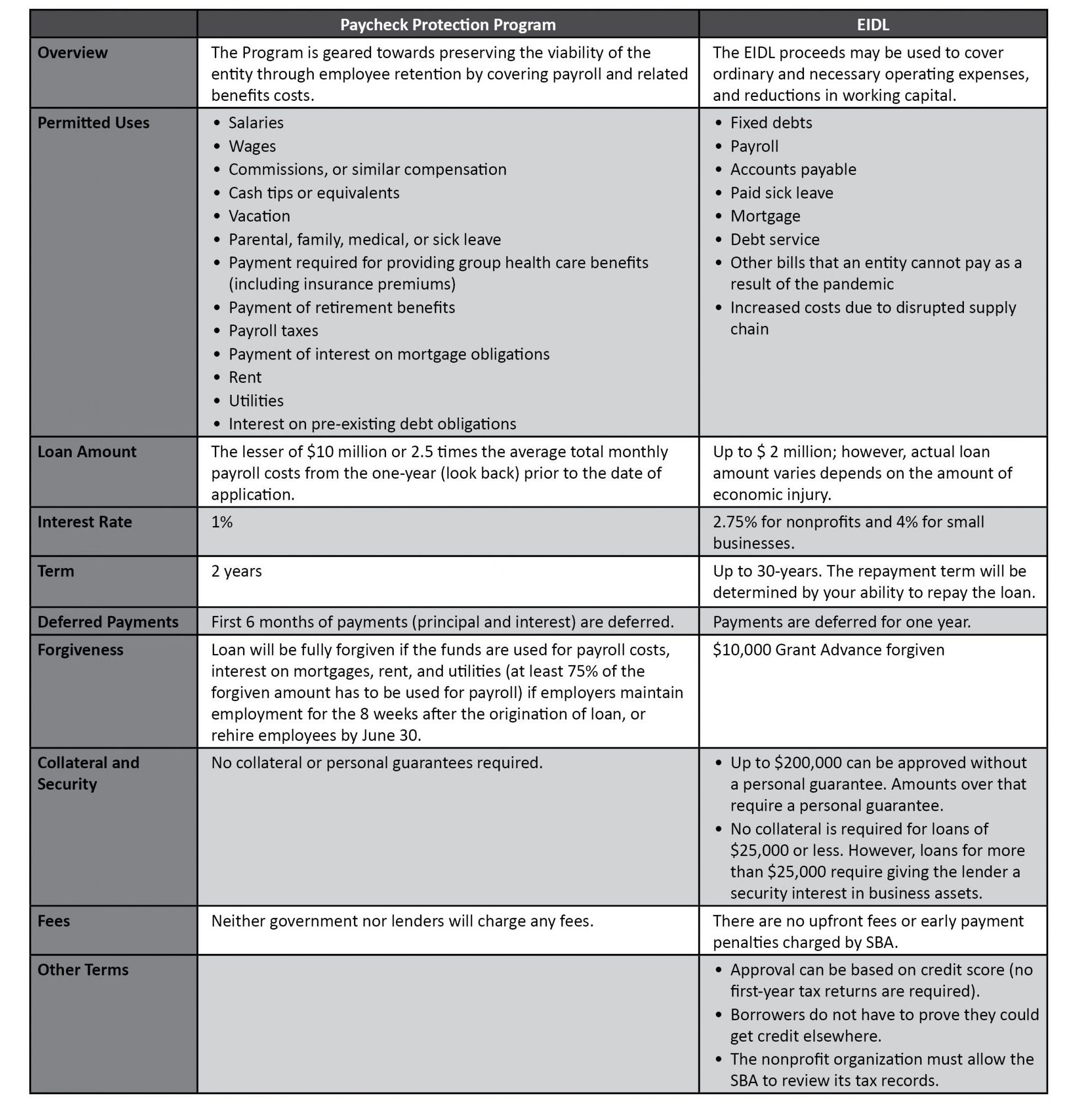

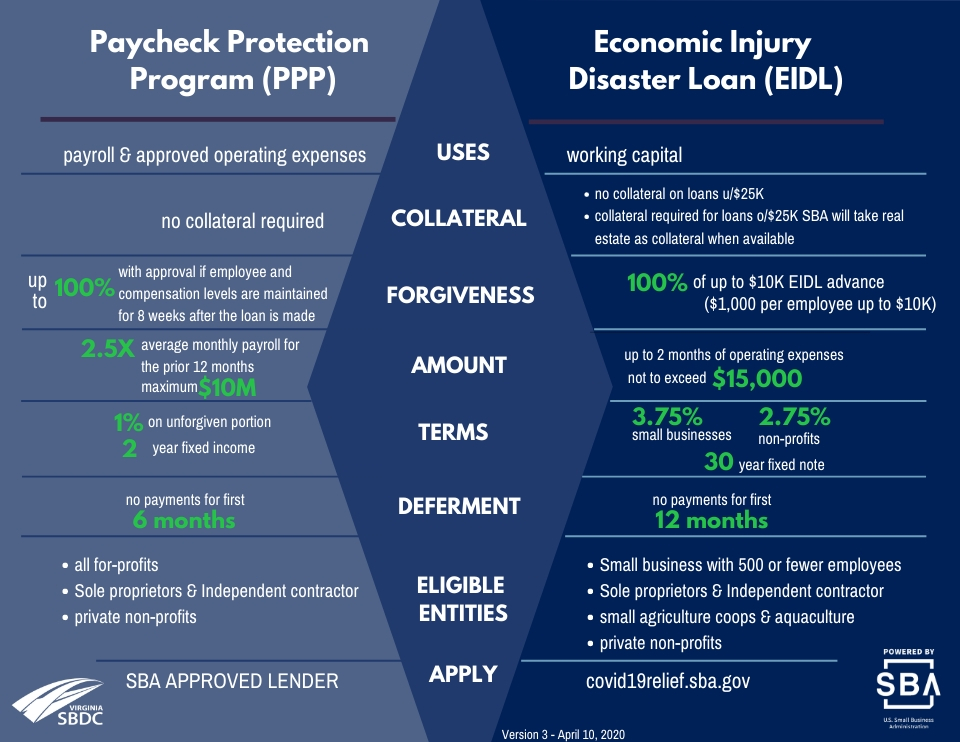

Eidl loan terms. Interest continues to accrue during the deferment period and borrowers may make full or partial payments if. Small businesses and nonprofits the US. Loans are for a term of 30 years All EIDL loans carry a term of 30 years with an interest rate of 375.

As part of the EIDL an advance of up to 10000 is available for those who apply for the EIDL. Summary of EIDL loan terms. EIDL Loan applicants can negotiate for a HIGHER loan amount.

Not the EIDL advance is no longer available to new applicants. The 2 million loan cap includes both physical disaster loans and EIDLs. This makes it an attractive option for small businesses to have access to additional liquidity and reduce the cash flow burden as they begin to rebuild their business.

The repayment term will be determined by your ability to repay the loan. 12 months from the date of the promissory note For loans less than 25000. That loan is a 30 year loan at 375 interest with no payments for the first year.

What are the Economic Injury Disaster Loan terms. 30-year terms Interest rates. The SBA informed us on June 24th that only around 30000 EIDL loan increases had been approved thats over about 10 weeks of the program being lived.

Since the EIDL loan increase program got underway in April 2021 the EIDL loan increase progress has been slow. Most EIDL loans have 30-year terms interest rates below 4 and payments deferred for up to two years although interest is accruing and business owners should be aware of that fact. What are the loan terms for Economic Injury Disaster Loans.

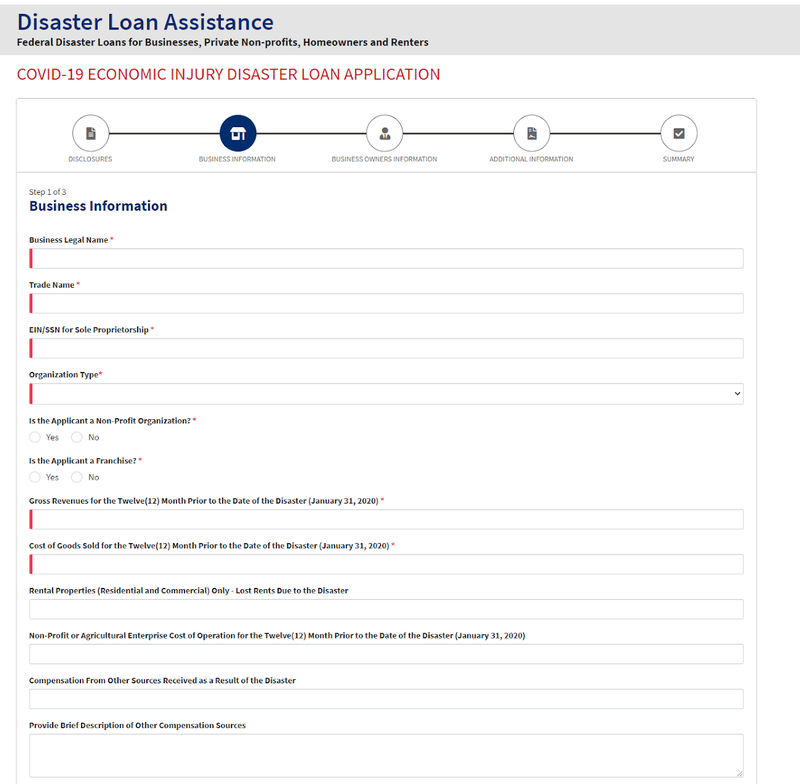

Your EIDL Loan invitation will be becoming via email 2-3 weeks after you received your EIDL gran. EIDL Part of Small Business Administration Disaster Loans Program The Small Business Administration SBA operates a general disaster loan program for business owners who have suffered significant economic losses due to a natural disaster terrorist attack public health emergency or other situation outside of their control. First the amount that you qualify for should be approximately six times the expenses of your business in a normal month.

For loans approved starting the week of April 6 2021. EIDL terms are substantially better than one might expect on an acquisition loan from the SBA. 24-months of economic injury with a maximum loan amount of 500000.

The EIDL loan program authorizes each borrower to qualify for a loan up to 2000000 as determined by the SBA. It should be covering six months of expenses. The advance portion of the loan will bebased on the number of employees in your business and will be 1000 per employee up to 10 employees or 10000.

375 for small businesses. COVID-19 EIDL loans are offered at very affordable terms with a 375 interest rate for small businesses and 275 interest rate for nonprofit organizations a 30-year maturity. For loans approved prior to the week of April 6 2021 see.

Repayment terms on the loans are over a 30-year term at 375. Small Business Administration reopened the economic injury disaster loan EIDL and EIDL advance program portal to all. Economic Injury Disaster Loans EIDL.

To keep monthly payments low the SBA offers long-term repayment plans to eligible borrowersup to 30 years. In order to meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. Heres the latest update of SBA Loans and Grants.

EIDL terms Unlike PPP loans disaster loans which carry a term of 30 years and a 375 interest rate require a personal guarantee and are backed by collateral for loans exceeding 25000. There are no upfront fees or early payment penalties charged by SBA. MORE EIDL APPROVALS coming in and Denials coming in.

The SBA takes a general security interest in any and all. The EIDL interest rate is currently 375 for small businesses and 275 for nonprofits. The SBA does NOT take a security interest in any collateral.

These loans are intended to. Loans are automatically placed into deferment the first year of the loan with repayment. To find out more on qualifications terms and loan repayment on EIDL refer to SBA EIDL LOAN TERMS For EIDL a personal credit check for all applicants plus a business credit check for all applicants except sole proprietors for loan amounts above 200000.

FAQ regarding COVID-19 EIDL. For loans greater than 25000. Working capital loans are available to assist small business concerns.

EIDL Loan Increases Face Internal SBA Challenges.

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

The Economic Injury Disaster Loan Vs The Paycheck Protection Program Wiss Company Llp

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Ppp Vs Eidl What Funding Is The Best Fit Alamance Strong

The Cares Act Sba 7 A Loans A Squared Legal Group Plc

5 Urgent Financial Strategies For Small Business Owners Right Now

Sba Eidl Loan Vs Sba Paycheck Protection Program Tmc Financing

5 Eidl Loan Terms And Requirements You Should Know The Blueprint

Cares Act Loan Faqs For Nonprofits Foundations And Small Businesses Nilan Johnson Lewis Pa Nilan Johnson Lewis Pa

Read And Review An Eidl Loan Document Before Accepting It Faqs Covid Loan Tracker

Covid 19 News Resources Small Business Development Center

Sba Issues Updated Eidl Loan And Eidl Grant Information

What Government Loan Program Should You Apply For

Covid 19 Financial Relief Assistance Programs

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Read And Review An Eidl Loan Document Before Accepting It Faqs Covid Loan Tracker

5 Eidl Loan Terms And Requirements You Should Know The Blueprint