Using PPP loan funds to cover personal expenses and other impermissible expenditures are issues that have already come up multiple times in DOJ PPP loan fraud investigations. What is PPP loan fraud.

341 Million In Ppp Fraud So Far And Counting Oxus Com

First within eight weeks of receiving the loan the proceeds must be used for payroll costs mortgage interest rent or utilities.

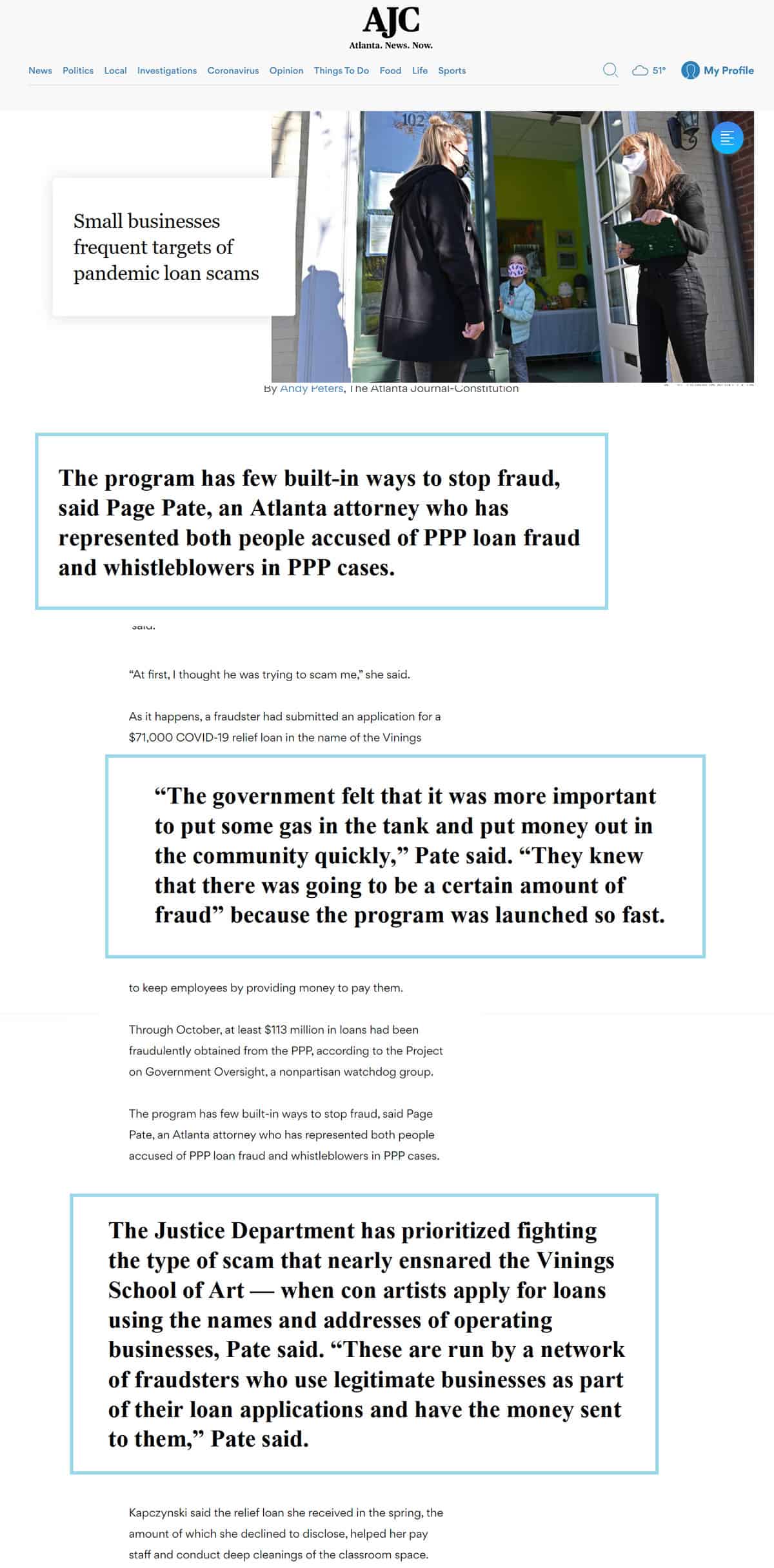

Ppp loan frauds. Some cases are substantial. The PPP was created to help companies stay in business during the coronavirus pandemic by providing forgivable loans to cover payroll and operating expenses. Report the fraud to them.

The Justice Department has brought criminal charges against at least 209 individuals in 119 cases related to Paycheck Protection Program PPP fraud since banks and other lenders began processing loan applications on behalf of the Small Business Administration on April 3 2020. Making false statements on your PPP application 2. PPP Loan Forgiveness Requirements.

The Justice Department has charged more than 120 defendants with fraud related to PPP loans. Common PPP Loan Fraud Triggers 1. Paycheck Protection Program PPP fraud.

The cases involve a range of conduct from individual business owners who have inflated their payroll expenses to obtain larger loans than they otherwise would have qualified. EnjoySo here are the links and resources I mentioned in this videohttpsrichsmith. PPP Loan Application Fraud While millions of small businesses were and remain eligible for PPP loans not all.

The Government alleged that the Kwaks submitted fraudulent loan applications on behalf of several shell companies to obtain over 4 million in COVID-19 relief funds. When Can the DOJ File Charges for PPP Loan Fraud. A key attraction to the PPP loans was that as long as recipients conformed to certain rules about maintaining workers the loans would be forgiven.

Again all expenditures from companies PPP loan accounts should be carefully tracked and documented. Prominent among the departments efforts have been cases brought by the Criminal Divisions Fraud Section involving at least 120 defendants charged with PPP fraud. The federal government has already been aggressively prosecuting individuals who have engaged in illegal conduct on their PPP loan applications.

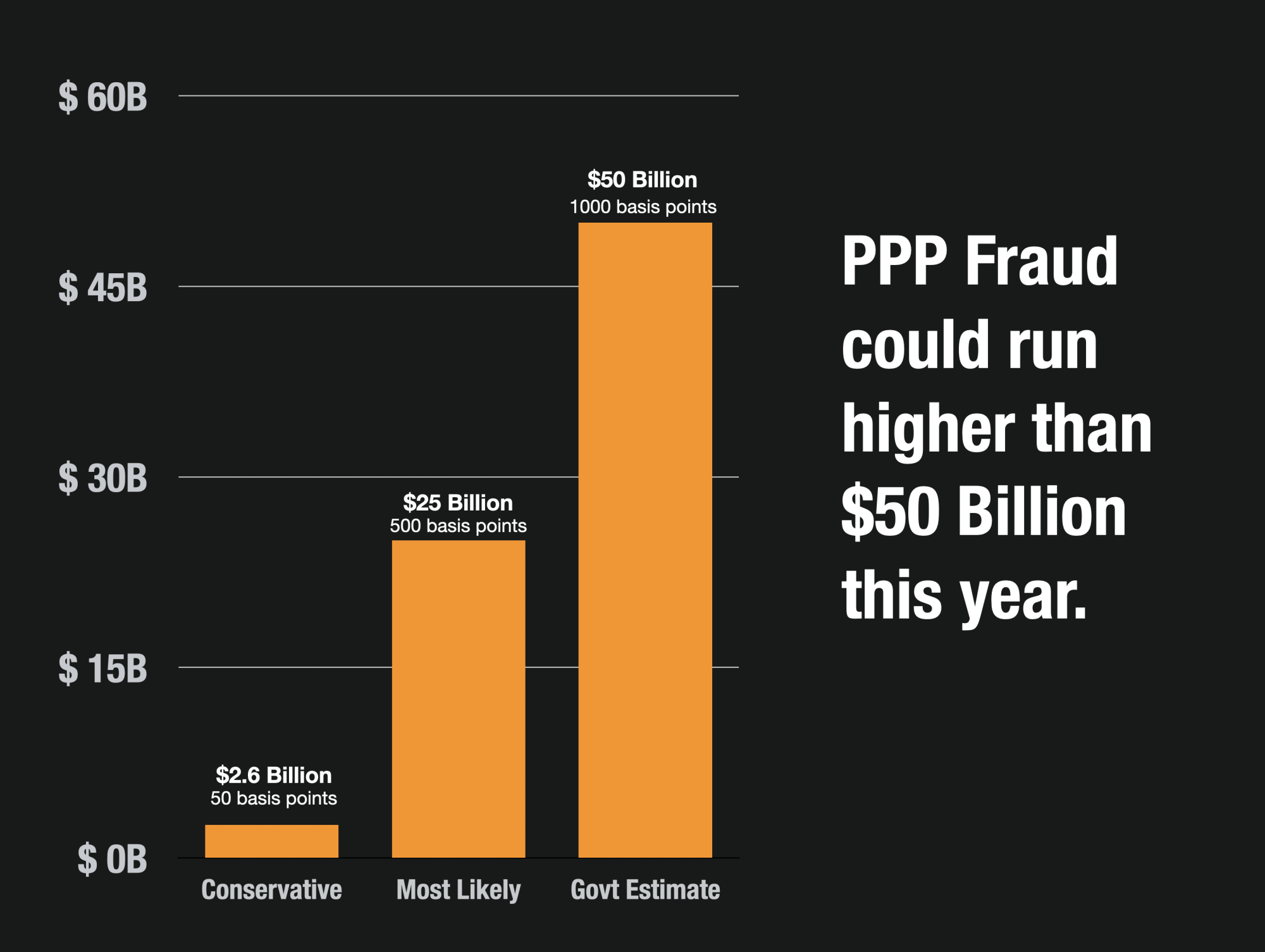

The federal Paycheck Protection Program PPP designed to blunt the economic impact of the pandemic is beset by extensive instances of fraud. According to the indictment Turasky had already been evicted from the restaurant rental space and her employees had been terminated before she applied for the PPP loan. Government has good reason to believe it wasnt all legitimate.

Businesses that receive funds can pursue loan forgiveness for PPP if they meet two requirements. Melissa Turasky a Chicago restaurateur was charged with submitting a fraudulent PPP loan application to obtain more than 175000 in a forgivable PPP loan. Second businesses must maintain their existing levels of employee compensation.

Five examples of PPP loan fraud include. CARES Act Fraud PPP loan fraud occurs when people intentionally obtain or attempt to obtain funds through the CARES Act that they are not entitled to. The case was brought in Atlanta Georgia.

Applying for multiple PPP loans across multiple lenders also called loan stacking 3. Then go to IdentityTheftgov to report the identity theft to the Federal Trade Commission FTC and. More than 900000 companies in Florida alone applied for money from The Paycheck Protection Program known.

Paul and Michelle Kwak were charged with conspiracy to commit wire fraud wire fraud and money laundering. PPP loans are loans intended as emergency relief for small business owners. If you suspect that someone applied for a Paycheck Protection Program PPP loan using your information.

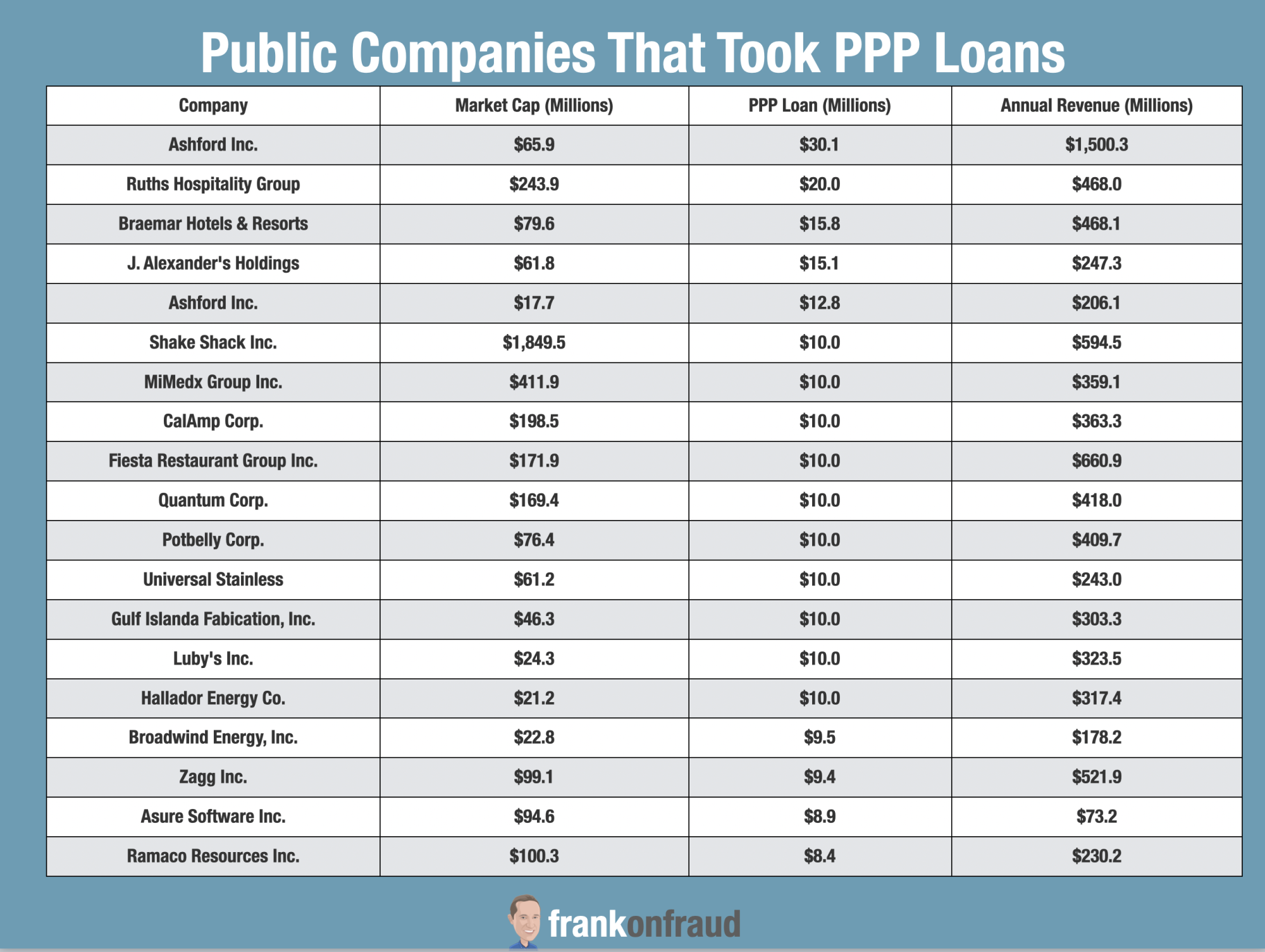

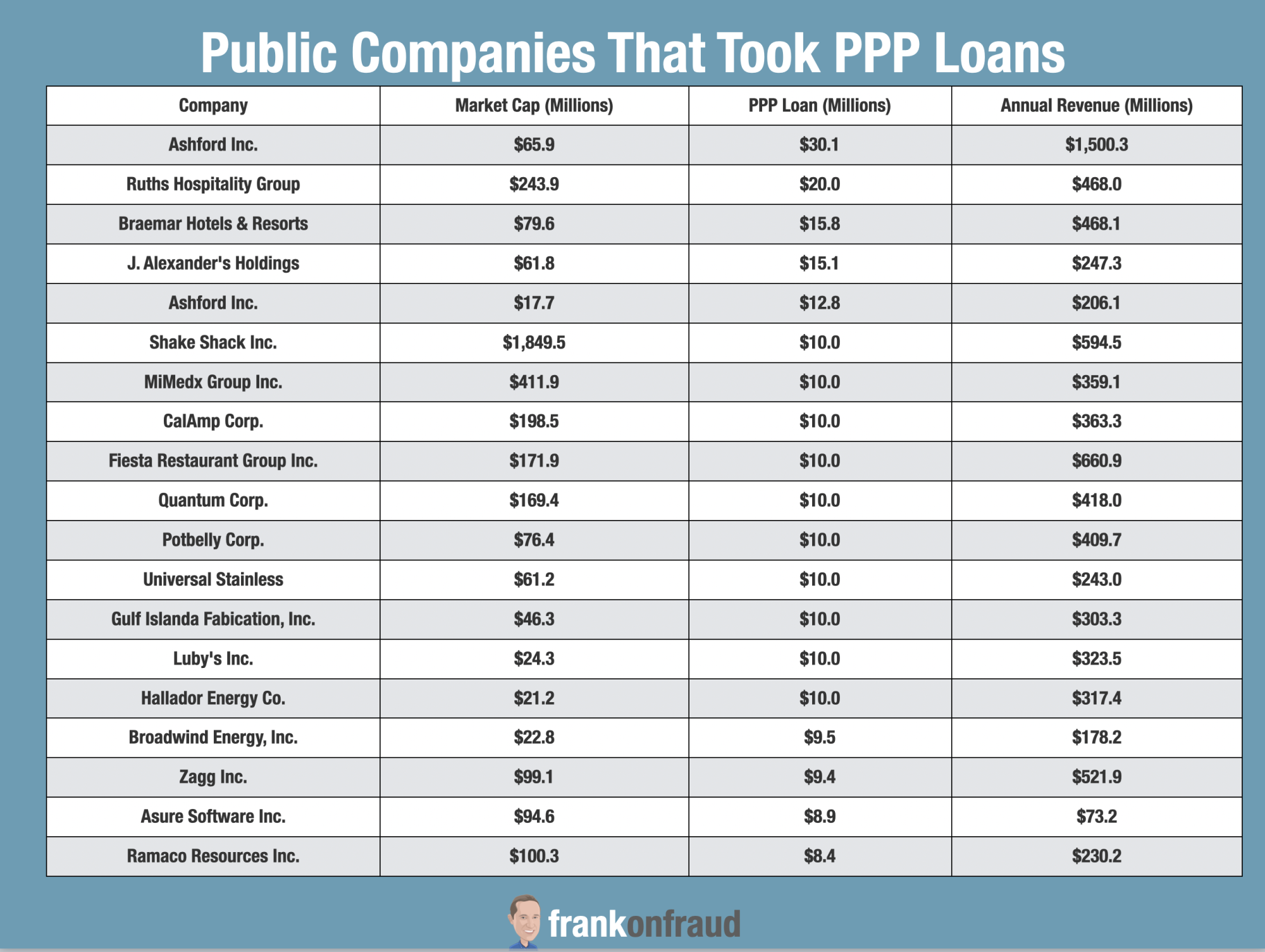

And these cases are just the beginning. Heres a breakdown of the PPP Loan Fraud List and who got a PPP Loan. Fraudulent Use of PPP Loan Funds Funds obtained under the PPP may only be used for the purposes authorized under the.

As of June 30 loans valued at 2 million or. Falsely claiming the company has fewer than 500 employees to qualify for the loan. PPP loan fraud could result in numerous federal criminal charges including wire fraud bank fraud mail fraud and identity theft depending on the circumstances of your case.

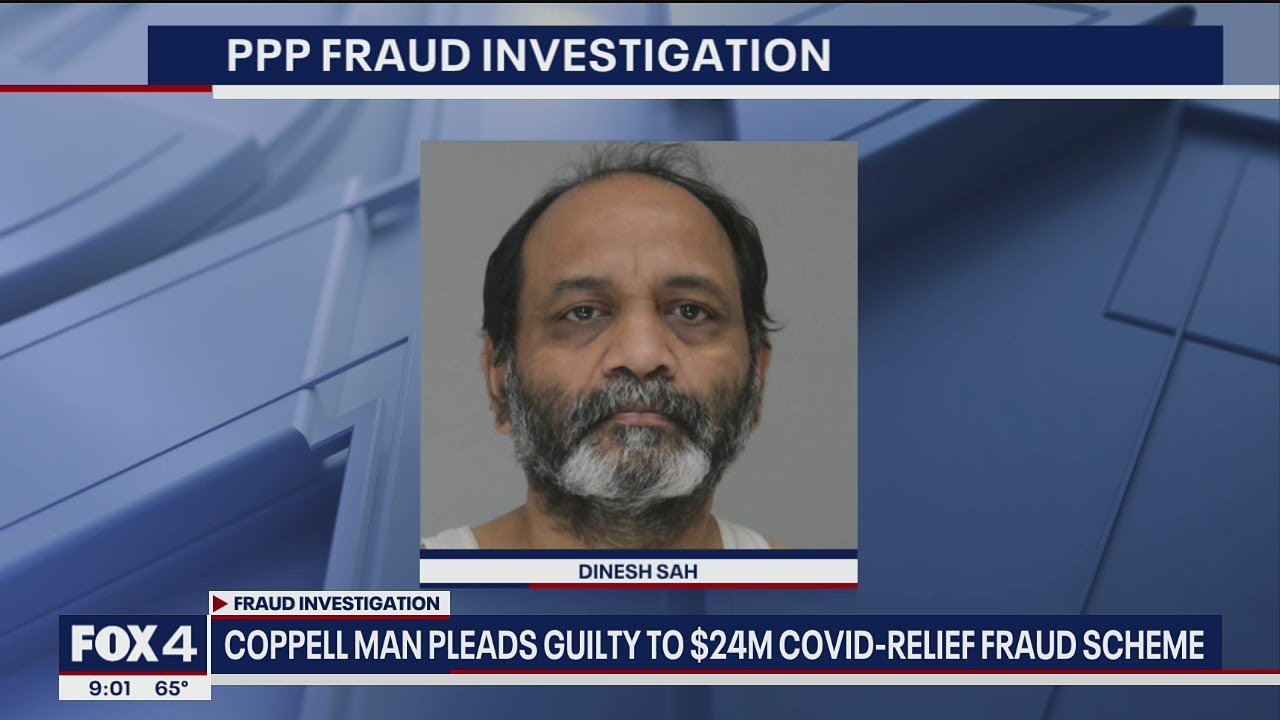

For example in March a Texas man pleaded guilty to a. Contact the lender that issued the loan. PPP loan fraud is when an individual or business submits false information in an application or certification for a loan under the federal Paycheck Protection Program PPP.

There is a political dimension to PPP fraud. Using awarded PPP funds for unapproved purposes.

Hundreds Of Ppp Loan Fraud Probes Have Been Opened Pymnts Com

Ppp Loan Fraud Investigations On The Rise

Updated List Of Ppp And Eidl Loan Fraud Criminal Cases

Trucking Company Owner Used 1 5m In Ppp Loans On Rolls Royce Jewelry Child Support Transportation Nation Network

Ppp Loan Fraud Definition Fraud Cases Sentencing And Key Details Youtube

Recent Doj Charges And Ppp Loan Compliance Federal Lawyer

Fraud Fallout From Ppp Loans It S Getting Bad Frank On Fraud

Pretty Ricky S Baby Blue To Plead Guilty To Ppp Loan Fraud

Ppp Fraud Arrest Just The Tiniest Tip Of The Iceberg Frank On Fraud

Ppp Fraud Government Loans And Federal Arrests Based On Covid 19 Relief Dallas Justice Blog

Ppp Loan Fraud River Daves Place

Baby Blue From Pretty Ricky Arrested For 24 Million Dollar Covid 19 Ppp Loan Fraud Hiphopoverload Com

Ppp Loan Fraud Arrests 2021 Zsa Zsa Couch Youtube

Lowcountry Charity Founder Accused Of Ppp Loan Fraud Wciv

Ohio Man Four Others Indicted For Alleged 4 Million Ppp Loan Fraud Wtvc

Man Admits Using Fraudulent Ppp Loans To Buy Luxury Cars Homes In Texas And California Youtube

Ppp Loan Fraud List Who Got A Ppp Loan Youtube

Ppp Loan Fraud Enforcement 2 0 Preparing For The Next Round Of Scrutiny