Walls in good condition All walls both interior and exterior must not have mold rotting or holes. The property to be financed should be located in one of the USDA designated rural areas.

Understanding Down Payments Home Loans Loan First Home Buyer

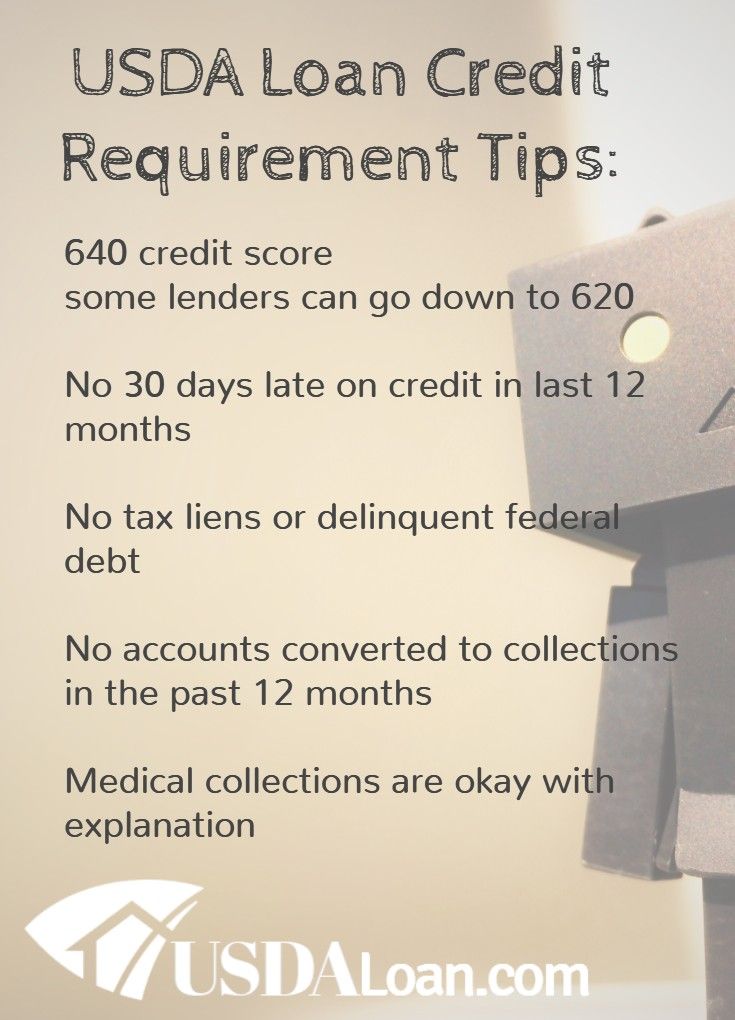

Non-citizen national or qualified alienAbility to prove creditworthiness typically with a credit score of at least 640Stable and dependable incomeA willingness to repay the mortgage - generally 12 months of no late payments or collections.

Usda home loan requirements. What are the requirements for a USDA Rural Home LoanUSDA Loan EligibilityUS. To finance an existing home with a USDA loan you must have a state-licensed inspector conduct an inspection of the entire home. However applicants with a credit score of 640 or higher are eligible for the USDAs automated underwriting system.

Heres an overview of the other requirements. Before the Agency makes a loan the Loan Originator must ensure that the applicant will have an appropriate form of ownership and that the Agencys interest in the property is adequately secured by the value of the real estate and the Agencys lien position. USDA loans are guaranteed by the US.

Year-round street access In any season cars should be able to access your home from the street with easy driveway and sidewalk access. Department of Agriculture and issued by private lendersThey require a 640 credit score and provide 100 financing so no down payment is required. At a minimum applicants interested in obtaining a direct loan must have an adjusted income that is at or below the applicable low-income limit for the area where they wish to buy a house and they must demonstrate a willingness and ability to repay debt.

To be eligible you must be buying a home in a USDA-eligible location and have a total household income that does not exceed 115 of the area median income AMI. For example in the Los Angeles metro area a 1-4 person household can make 98200 and still qualify for a USDA home loan. The Home Requirements All USDA homes must have.

In order to be eligible for many USDA loans household income must meet certain guidelines. Citizenship or legal permanent resident ie. With regard to income requirements the max DTI ratio is 2941 meaning the housing payment cant exceed 29 of gross monthly income.

The Section 502 Guaranteed Loan Program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate modest decent safe and sanitary dwellings as their primary residence in eligible rural areas. USDA Loan Credit Requirements There are some mandatory requirements that must be satisfied for a USDA loan. USDA provides homeownership opportunities to low- and moderate-income rural Americans through several loan grant and loan guarantee programs.

The US Department of Agriculture requires that all applications for USDA debt be processed through local lendersbanks which is what Trinity Oaks Mortgage does day in and day out for our clients. Also the home to be purchased must be located in an eligible rural area as defined by USDA. A borrower must be income-eligible demonstrate a credit history that indicates ability and willingness to repay a loan and meet a variety of other program requirements.

This includes minimum credit scores and other aspects of credit history. If you have confusions you can take help from the Federal Home Loan Centres Counsellors to. What Are USDA Loan Requirements.

USDA loan requirements USDA eligibility is based on the buyer and the property. Section 4 specifies Agency security requirements and Section 5 provides guidance on. FSA loans can be used to purchase land livestock equipment feed seed and supplies.

There is no minimum credit requirement for the USDA loan. USDA Loan Credit Requirements Applicants must show stable and dependent income and a credit history that demonstrates the ability and willingness to repay the loan. This chapter provides guidance for.

You need to meet certain criteria to be considered for a USDA construction loan or a USDA loan to buy a home. For example you must live in the home and it must be your primary residence. At a minimum applicants interested in obtaining a direct loan must have an adjusted income that is at or below the applicable low-income limit for the area where they wish to buy a house and they must demonstrate a willingness and ability to repay debt.

USDA Loan Requirements To qualify for a USDA loan the requirements are as follows. Credit Score A minimum credit score of 640 is required for an automated approval. To qualify for a USDA home loan an applicant must meet the following requirements as determined by USDA Rural Development.

Loans can also be used to construct buildings or make farm improvements. Assistance is a significant responsibility of Loan Originators and Loan Approval Officials. USDA Loan for Existing Dwelling Any home that is more than 12 months old is classified as an existing dwelling.

First the home must be in a qualified rural area which USDA typically defines as a population of less than.

Usda Home Loan Program Highlights Usda Loan Mortgage Loan Originator Home Loans

Kentucky Usda Rural Housing Loans List Of Government Foreclosure Homes For Sale By First Time Home Buyers Buying First Home Home Renovation Loan

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Real Estate Infographic Buying First Home Real Estate Quotes

Complete List Of Mortgage Application Documents Hsh Com Refinance Mortgage Mortgage Loans Mortgage Tips

Kentucky First Time Home Buyer Mortgage Loans Down Payment And Credit Score Requirements For A Kentucky Fh Mortgage Loans First Time Home Buyers Home Mortgage

Tumblr Usda Loan Home Loans Usda

Va Loan Pros And Cons Va Loan Loan Rates Va Mortgage Loans

Usda Loans Info Usda Loan Usda Home Buying Checklist

Understanding Mortgages Understanding Mortgages Usda Loan Mortgage

Kentucky Usda Rural Housing Loans Kentucky Usda Rural Development Loans Program Guid Rural Development Loan Refinance Loans Home Loans

What Are The Kentucky Fha Credit Score Requirements For 2020 Mortgage Loan Approvals Kentucky Fha Mortgage Loans Guidelines Fha Loans Mortgage Loans Fha

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Fha

A Href Https Www Mortgagecalculator Org Helpful Advice Types Of Mortgages Php Epik Dj0yjnu9afdmztrplu14atn2vwhfu In 2021 Understanding Mortgages Usda Loan Mortgage

Pin On Usda Home Loan Education

Usda Mortgage Insurance Premium Mortgage Loans Usda Loan Usda

How To Qualify For A Usda Home Loan Home Loans Best Homeowners Insurance Mortgage Marketing

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loans In 2021 Usda Loan Mortgage Kentucky

What Is A Usda Loan Eligibility Rates Advantages For 2018 Usda Loan Usda Loan Requirements Loan