There is no minimum credit requirement for the USDA loan. Borrowers with a credit score as low as 500 may qualify with a 10 down payment and need a 580 credit score with just 35 down.

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Fha

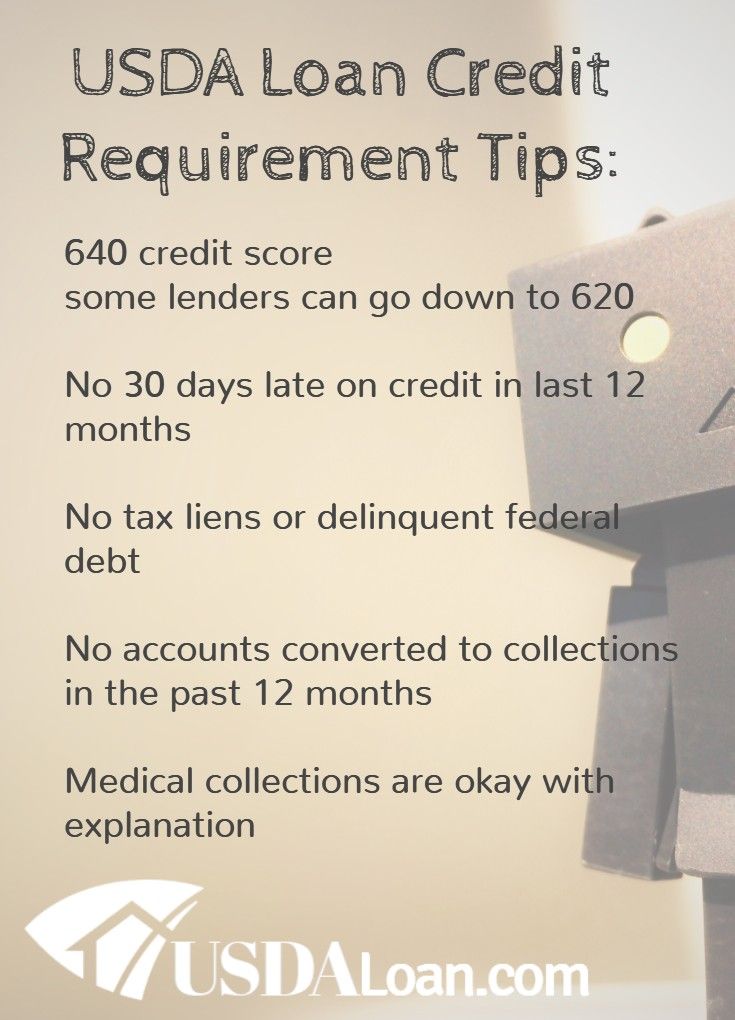

However applicants with a credit score of 640 or higher are eligible for the USDAs automated underwriting system.

Usda loan requirements. Credit scores FHA loans have the lowest credit requirements of any mortgage loan. For eligible customers options like FHA VA and the Guaranteed Rural Housing programs may. USDA Loan Property Condition Requirements.

Basic USDA loan requirements include. USDA loans are mortgage loans that help make purchasing a home more affordable for those living in rural areas. Also the home to be purchased must be located in an eligible rural area as.

First the home must be in a qualified rural area which USDA typically defines as a population of less than. However borrowers must demonstrate compensating factors to Rural Development in order to be eligible for the 21 temporary buydown option as defined in Rural Development Instruction 1980345c5 Determining regular payment amounts. In addition to a property falling within the confines of what is considered modest housing a home must also meet strict quality assurance guidelines.

Offer low down payment programs. Assistance is a significant responsibility of Loan Originators and Loan Approval Officials. USDA Loan does not have any specific credit requirements in order to use the 21 temporary buydown.

You must be unable to qualify for a conventional loan without private mortgage. Welcome to the USDA Income and Property Eligibility Site. This site is used to evaluate the likelihood that a potential applicant would be eligible for program assistance.

7 CFR Part 3555 - This part sets forth policies for the Single-Family Housing Guaranteed Loan Program SFHGLP administered by USDA Rural Development. In order to be eligible for many USDA loans household income must meet certain guidelines. The condition of the property you want to finance with a USDA loan must meet certain requirements.

Rural Development however does not guarantee the accuracy or completeness of any information product process or determination provided by this system. To qualify for a USDA loan you. USDA loan requirements.

A borrower must be income-eligible demonstrate a credit history that indicates ability and willingness to repay a loan and meet a variety of other program requirements. You may be able to roll your closing costs into your loan. Applicants must show stable and dependent income and a credit history that demonstrates the ability and willingness to repay the loan.

Every effort is made to provide accurate and complete information regarding eligible and ineligible areas on this website based on Rural Development rural area requirements. Do not have to be a first-time homebuyer. USDA provides homeownership opportunities to low- and moderate-income rural Americans through several loan grant and loan guarantee programs.

FSA loans can be used to purchase land livestock equipment feed seed and supplies. USDA home loan qualifications and requirements. Government mortgage loan options.

It addresses the requirements of section 502 h of the Housing Act of 1949 as amended and includes policies regarding originating servicing holding and liquidating SFHGLP loans. The USDA monthly guarantee fee is lower than FHA monthly mortgage insurance in most cases and you may be able to roll these fees into your loan. This government backing means compared to conventional loans mortgage lenders can offer lower interest rates.

More USDA vs. You can qualify with a credit score as low as 640. Talk with a home mortgage consultant about loan amount type of loan property type income first-time homebuyer and homebuyer education requirements to ensure eligibility.

Department of Agriculture backs USDA loans in the same way the Department of Veterans Affairs backs VA loans for veterans and their families. USDA appraisals have stricter guidelines than conventional loans which could save you from pulling the trigger on a home requiring expensive repairs. FHA Loans Key Differences.

This chapter provides guidance for. If you have confusions you can take help from the Federal Home Loan Centres Counsellors to determine whether the property is. The property to be financed should be located in one of the USDA designated rural areas.

USDA loans require no down payment unlike FHA and conventional loans. USDA guaranteed loans dont require a minimum down payment but other requirements are highly specific. Clean credit history No late payments or recent bankruptcy or foreclosure.

USDA Loan Credit Requirements. Must be a US. USDA eligibility is based on the buyer and the property.

Loans can also be used to construct buildings or make farm improvements. Designed for low-income buyers. To qualify for a USDA loan the requirements are as follows.

Minimum credit score 640 with most lenders. Do not have to be employed in the agricultural industry even though the Department of Agriculture backs the loans.

How To Qualify For A Usda Home Loan Home Loans Best Homeowners Insurance Mortgage Marketing

Kentucky Usda Rural Development Loans Rural Development Loan Rural Kentucky

Usda Mortgage Insurance Premium Mortgage Loans Usda Loan Usda

What Are The Kentucky Fha Credit Score Requirements For 2020 Mortgage Loan Approvals Kentucky Fha Mortgage Loans Guidelines Fha Loans Mortgage Loans Fha

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Real Estate Infographic Buying First Home Real Estate Quotes

A Href Https Www Mortgagecalculator Org Helpful Advice Types Of Mortgages Php Epik Dj0yjnu9afdmztrplu14atn2vwhfu In 2021 Understanding Mortgages Usda Loan Mortgage

Tumblr Usda Loan Home Loans Usda

Usda Better Program Vs Fha First Time Home Buyers First Home Buyer Home Buying Process

Insane But True Facts About The Usda Mortgage Usda Loan Mortgage Amortization Amortization Schedule

What Is A Usda Loan Eligibility Rates Advantages For 2018 Usda Loan Usda Loan Requirements Loan

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loans In 2021 Usda Loan Mortgage Kentucky

Pin On Usda Home Loan Education

Understanding Down Payments Home Loans Loan First Home Buyer

Pin On Kentucky Fha Va Usda Khc Jumbo And Fannie Mae Mortgage Loans In Ky

Usda Loans Info Usda Loan Usda Home Buying Checklist

Kentucky Usda Rural Housing Loans Kentucky Usda Rural Development Loans Program Guid Rural Development Loan Refinance Loans Home Loans

Understanding Mortgages Understanding Mortgages Usda Loan Mortgage

Kentucky First Time Home Buyer Mortgage Loans Down Payment And Credit Score Requirements For A Kentucky Fh Mortgage Loans First Time Home Buyers Home Mortgage