The USDA does not issue loan limits on Guaranteed Loans so there is no cap on how much a lender is allowed to approve for a USDA loan. Theres a catch though.

Kentucky First Time Home Buyer Mortgage Loans Down Payment And Credit Score Requirements For A Kentucky Fh Mortgage Loans First Time Home Buyers Home Mortgage

USDA-backed mortgages are typically originated by approved lenders though the USDA does offer a direct loan option.

What is a usda loan. To determine if a property is located in an eligible rural area click on one of the USDA Loan program links above and then select the Property. However loan amounts are naturally constrained by the income limits your credit score savings and debt-to-income ratio. Department of Agriculture as part of its Rural Development Guaranteed Housing Loan program.

A USDA loan is a mortgage thats available for low-income borrowers in specific designated rural areas. The Section 502 Guaranteed Loan Program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate modest decent safe and sanitary dwellings as their primary residence in eligible rural areas. USDA loans are home loans issued or guaranteed by the United States Department of Agriculture.

What does this program do. USDA loans are zero-down-payment low interest rate mortgages. Direct loans are intended for low- or very low-income families who dont.

USDA loans are low-interest mortgages with zero down payments designed for low-income Americans who dont have good enough credit to qualify for traditional mortgages. The USDA loans goal is provide a safe and sanitary residence for low to moderate-income households. One of the biggest draws of the Rural Development program is that it doesnt require any down payment.

You can secure 100 financing for a home with the USDA loan. They help very low-to-moderate income buyers become homeowners. You must use a USDA loan to buy a home in a designated area that covers several rural and suburban locations.

You must buy a home in the USDA loan areas. A few of these property requirements include. With a USDA loan youre eligible for a 0 down payment.

The home must be in a rural area which the USDA defines as having a population under 35000. Its offered by the United States Department of Agriculture. A USDA Loan is for low-to-moderate income borrowers who buy a home in rural or suburban US.

To learn more about USDA home loan programs and how to apply for a USDA loan click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. The areas change approximately every 3 to 5 years. These loans are part of the USDAs Rural Development program meant to encourage homeownership in.

USDA loans are mortgages backed the US. There are a few suburban areas that meet the USDA criteria. To meet this goal the USDA sets basic property requirements that protect homebuyers as well as lenders.

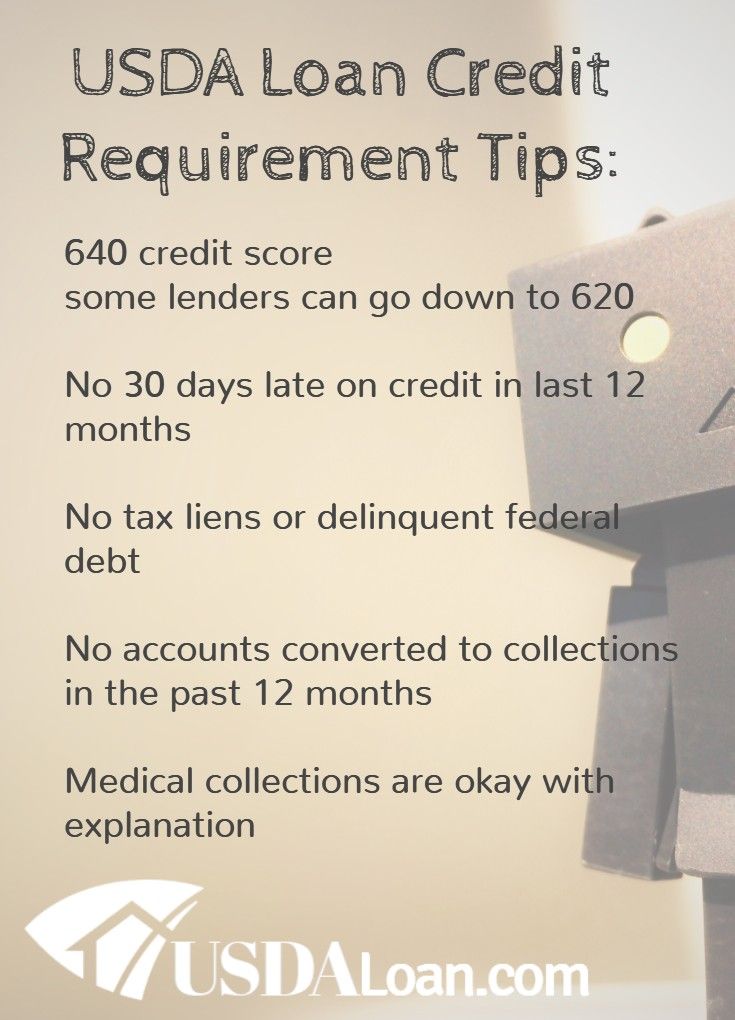

USDA loans can be used to buy or repair an eligible home in a rural area. Through the USDA loan eligible homebuyers can purchase build or refinance a home. USDA loans dont require any down payment but youll need at least a 640 credit score.

These loans are backed or issued by. The United States Department of Agriculture guarantees the loans. A USDA home loan is a type of mortgage for eligible rural and suburban homebuyers.

USDA loans are available to home buyers with low-to-average. Credit Karma receives compensation from third-party advertisers but. USDA loans are issued through the USDA Rural Development Guaranteed Housing Loan Program.

Theyre designed for people with income below certain limits who cant find another affordable loan.

Usda Home Loan Program Highlights Usda Loan Mortgage Loan Originator Home Loans

Kentucky Usda Rural Housing Loans How To Get A Usda Rural Housing Loan In Kentucky Loans For Bad Credit Usda Loan No Credit Loans

What Is A Usda Loan Eligibility Rates Advantages For 2018 Usda Loan Usda Loan Requirements Loan

Kentucky Usda Rural Housing Loans Difference Between 502 Guarantee Loan And Direct Loan For Rhs Usda Loan In Kentucky Guaranteed Loan Usda Loan Loan

Tumblr Usda Loan Home Loans Usda

What Are The Kentucky Fha Credit Score Requirements For 2020 Mortgage Loan Approvals Kentucky Fha Mortgage Loans Guidelines Fha Loans Mortgage Loans Fha

A Href Https Www Mortgagecalculator Org Helpful Advice Types Of Mortgages Php Epik Dj0yjnu9afdmztrplu14atn2vwhfu In 2021 Understanding Mortgages Usda Loan Mortgage

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentucky Va H Va Loan Loan Rates Va Mortgage Loans

How To Qualify For A Usda Home Loan Home Loans Best Homeowners Insurance Mortgage Marketing

Understanding Mortgages Understanding Mortgages Usda Loan Mortgage

Usda Mortgage Insurance Premium Mortgage Loans Usda Loan Usda

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Fha

Pin On Pinterest Real Estate Group Board

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Real Estate Infographic Buying First Home Real Estate Quotes

Usda Loans Info Usda Loan Usda Home Buying Checklist

Usda Loans How Do They Work Usda Loan Loan Usda